ED imaging demand skyrocketed in 2021, and many radiology providers are struggling to keep up. What's next for the specialty?

The United States has faced a growing shortage of physicians for some time. This long-term trend—coupled with the pandemic and increased imaging demand throughout 2021—have led to a highly competitive radiologist employment market at a time when practices find themselves short-staffed, overworked, and in need of relief.

The growing imbalance between radiologist supply and imaging demand has affected radiology providers of all types. To learn more about the ongoing situation, Radiology Business sat down with two executives from Virtual Radiologic (vRad) for their unique national perspective of serving over 2,100 facilities and radiology groups across the U.S.

Benjamin W. Strong, MD, vRad's chief medical officer, and Joe Schmugge, the company's senior vice president of operations, both chatted at length about what radiology looks like in 2021—and what that means for the specialty's future.

What's the situation when it comes to imaging volume this year? What do you think has led to this environment?

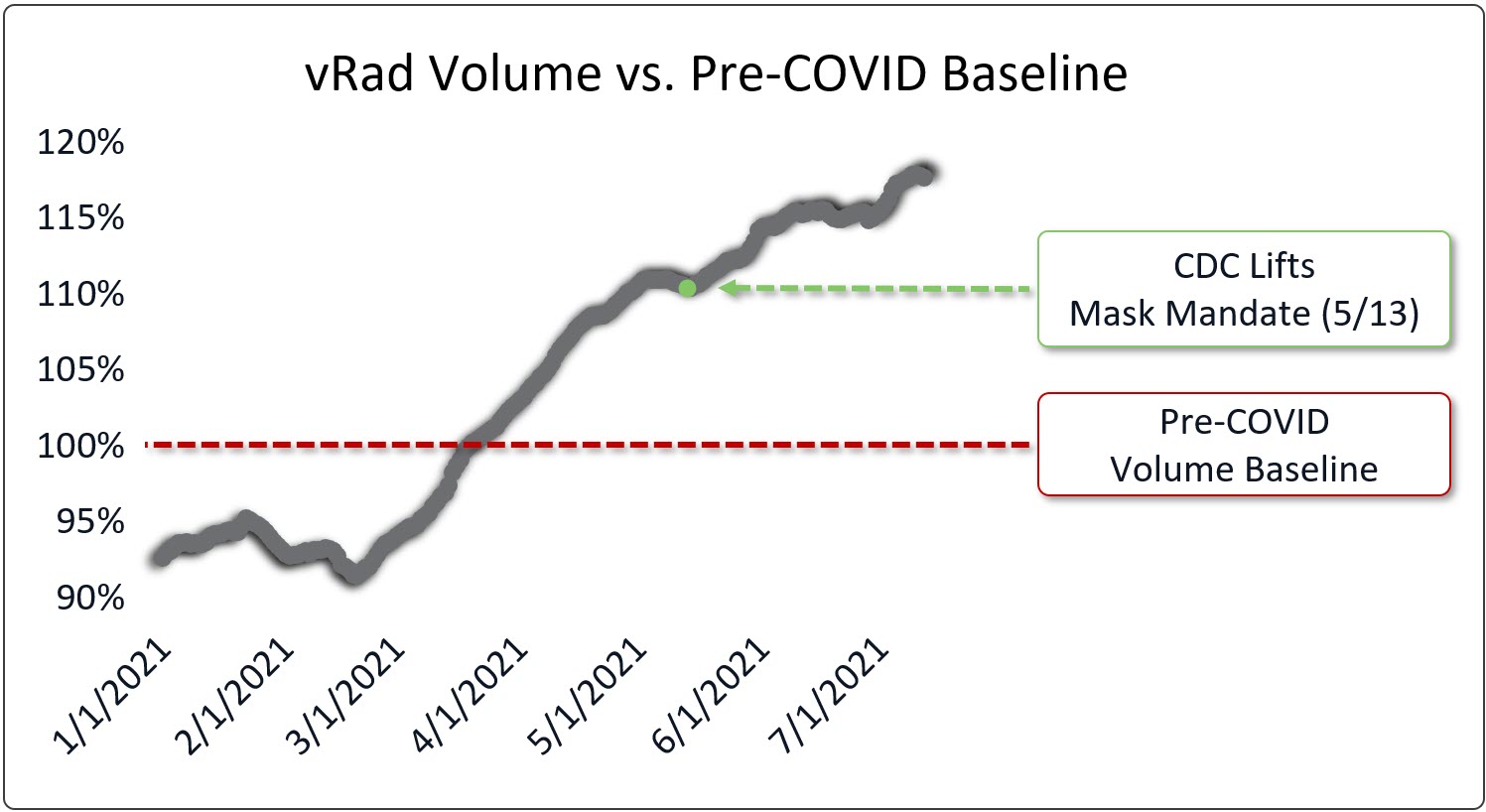

Joe Schmugge: As recently as January 2021, ED visits remained below pre-pandemic levels, according to a CDC report earlier this year. By mid-March however, we saw ED imaging volume fully recover to the pre-pandemic baseline. In the same timeframe, we were reading stories from places around the U.S. like Oregon and Minnesota reporting a similar surge in ED traffic. Throughout the summer, imaging volume continued climbing to new highs relative to our 20 years of tracking radiology data. Today, we continue to see many markets from coast to coast trying to manage heavy demand for radiology services which is creating service level challenges for local practices and teleradiology providers alike.

We believe there are three primary reasons for the surge in imaging this year. First, some patients temporarily delayed care amid the pandemic resulting in emergency room visits and urgent imaging performed in 2021. Second, the country largely reopened. Travel resumed, events returned, and social venues became widely available by spring break—resulting rising emergent imaging volume. It really felt like a return to form.

The final trigger appeared to occur when the CDC lifted the mask mandate on May 13th. Within about 48 hours of the new guidance, we began seeing national ED and imaging volumes increase significantly. This third element affecting the 2021 radiology marketplace appeared to propel record growth levels in imaging volume well into the summer months and is a standout event we have no parallel to in our history.

Ben Strong: There's another important piece of the puzzle to consider here as well: the radiology workforce has also changed dramatically due to the pandemic.

For instance, some radiologists planned to retire in 2020, but they postponed their retirement due to financial uncertainty. Now that the financial markets have bounced back, retirements are taking place, affecting the number of specialists available to read exams nationwide.

On a similar note, radiologists—just like so many other people—were unable to take much time off for travel throughout most of 2020. This results in a workforce that is both anxious to get away and less capable of flexing up in the event of a surge in demand. Now that it's 2021, even though COVID-19 certainly hasn't gone away, many radiologists are finally able to take vacations and visit family and friends. But, again, it affects the number of specialists who are available to read exams.

The radiologist recruitment market has also heated up, with practices making a lot of big offers to try and bring in new talent. And when radiologists take those offers, it has this incredible ripple effect. The radiologist's old practice is suddenly trying to get the same amount of work done with one less person, causing the remaining specialists to feel overworked. When they feel overworked, of course, it makes them want to depart. So it creates this cycle that is doing severe damage to practices and creating a lot of vacancies.

One common theme when you look at all of these things is that they put a lot of radiology practices at a serious disadvantage. It leaves them with holes they can't fill, particularly when it comes to exams that need to be read after hours. In fact, more than 65% of our existing clients are sending us more volume today than before the pandemic.

Should the ongoing situation worry hospitals and health systems? What can they do to survive now and thrive in the face of future shifts in supply/demand?

Ben Strong: I do think it is worrisome. The skewed ratio between demand and capacity has been building for years now, and the pandemic accelerated everything. For now, people are just throwing money at it. I think the radiology market will continue to be competitive with these enticing offers, and it's going to be pretty disruptive without really increasing the national capacity.

Taking a long-term look at things, the shift we're experiencing right now is one of those events that should worry radiologists. The hospitals aren't going to stand for this forever; they're going to start poking around at other alternatives, including allowing radiology physician assistants or other medical specialties the privileges to interpret imaging studies.”

As a specialty, radiology just has not been crushing it in terms of bringing in new radiologists for the last several years. We aren't increasing the number of residency slots, so there's not going to be some sudden influx of new trainees, which means this ongoing supply and demand issue likely won't be going away.

I can tell you that we’re not waiting around. When I started at vRad 17 years ago they had already decided that technology was the answer to many of the challenges facing radiology and we’re applying that same philosophy to the current situation.

Joe Schmugge: I agree. The AI, Natural Language Processing, and automated workflow technologies we’ve implemented in recent years have been vital in our ability to keep stable turnaround times for our stroke and trauma patients – even as we’ve experience unprecedented volume growth from local groups turning to us as a relief valve. Investing in ways to improve overall workflows and ensuring triage services remain stable for critical patients is fundamental to the future of radiology services.

Are vRad and other teleradiology providers in a better position to make it through this shift in volume than other practices?

Ben Strong: Well, yes, we are better equipped for something like this in that we have a very large group of radiologists and many processes to act as a buffer. However, there are still limitations to even what we can do. People often assume that we have unlimited capacity—and I sure wish we did, but that just isn't the case. It's also affecting us, so we remain focused on retaining our physicians and attracting new ones.

To that end, I am excited to say we just announced the largest radiologist compensation increase in the history of our practice for 2022. We want to be the best place to practice radiology and a great partner to the many hospitals, imaging centers and radiology providers in need of support.

The radiology market continues to evolve, and we are focused on preparing for the future.

Editor's note: learn more about vRad's Services of Excellence for Stroke and Trauma Imaging