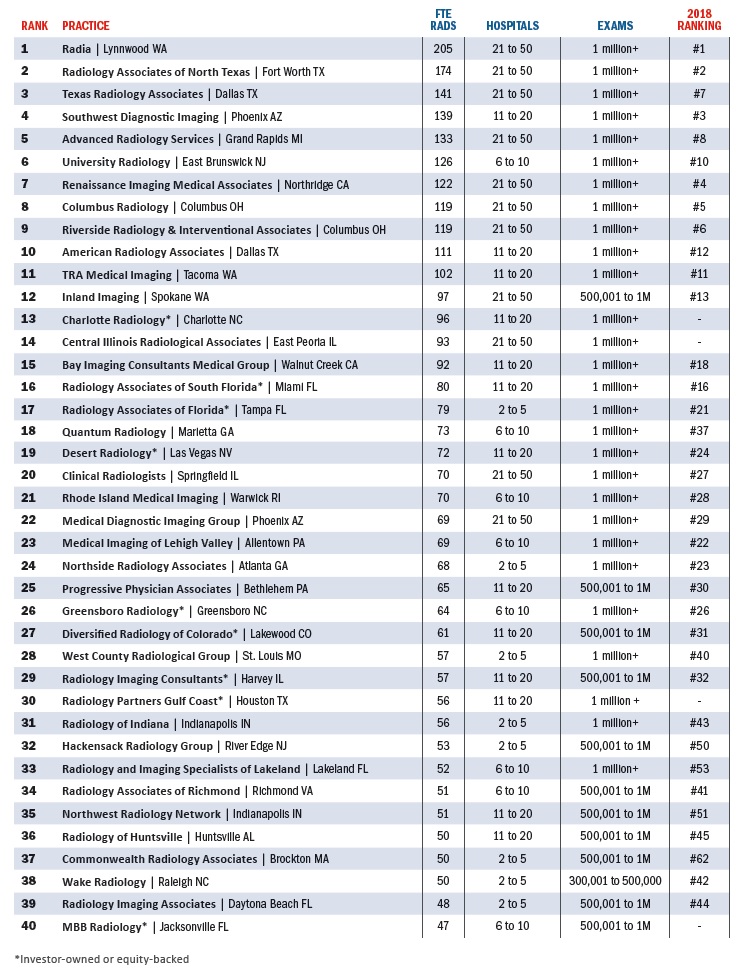

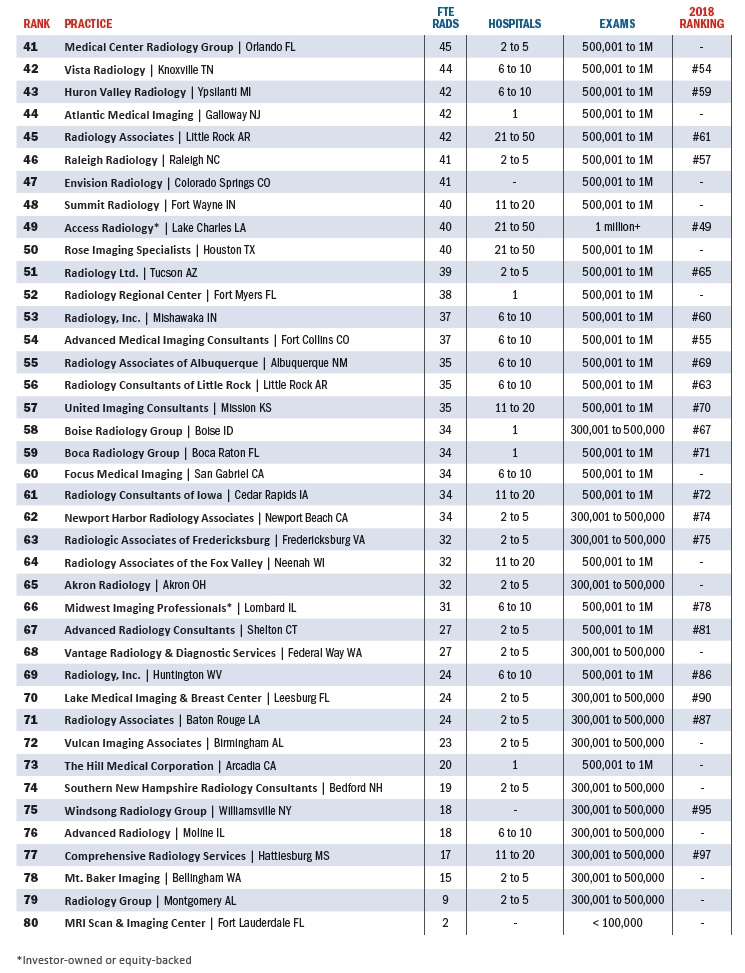

2019 Group Practice Survey: The Exemplary 80

Like reading-room lightboxes, the CT slice wars and loosely monitored radiation doses, RBJ’s Radiology 100 survey of years past has morphed into something new.

Why call it the Exemplary 80? Because radiology is evolving, consolidating and all the while innovating in this time of transition from volume to value across U.S. healthcare.

And because we believe the compressed field reflects the shape of the marketplace, offering an illuminating look at the state of group-practice radiology in 2019.

The accompanying charts and graphs bear this out, as do the insights offered anonymously by entrants asked to describe their most pressing challenges. You’ll find a number of these comments sprinkled over the next few pages.

The aggregated responses to questions beyond headcounts also brought some interesting insights. More on that further in. But first a few notes on the listings:

▲ Radiologist FTEs submitted as fractions have been rounded to the nearest whole number.

▲ Tiebreakers for practices with the same radiologist FTE counts were numbers of, in order: advanced practitioners, nonclinical staff outside IT, IT staff, procedures and hospitals served.

▲ This year we asked for a projection on procedure count through the current year rather than last year’s counts. The aim was to be as current as possible.

Equity in the Equation

Astute readers will note that we’ve dropped independent from our characterizations of the groups making the list. Not long ago some might have considered it a sacrilege for this project to mix privately owned groups with those that answer to investors. That viewpoint is definitely defensible, but the latter are increasingly a part of the group-practice landscape. Their growing presence is better acknowledged than ignored. It’s yet another reminder of new market dynamics at work.

In fact, Big Money’s interest in specialty medical practices, including those in radiology, is germane: It probably has something to do with the evolution of the Radiology 100 to this year’s Exemplary 80.

Consolidation has been rocking radiology for some time now, and equity’s entry into the field is all about achieving economies of scale by finding ways to consolidate.

This shows up as, for example, the heavy presence on the list of practices operating under the banner of El Segundo, Calif.-based Radiology Partners (RP). Eight of the 11 practices identified as investor-owned or equity-backed are affiliates of RP. Two are with US Radiology Specialists and one is with Mednax.

RP also entered as a single entity with 1,250 radiologists. This would easily have put them at No. 1. However, since numerous RP practices entered individually, the umbrella entity was disqualified from entering on its own and, in effect, entering those groups twice.

Also of note, the RP practices used varying language to describe their ownership status, so we checked with their corporate office. They requested the use of “physician-owned, equity-backed,” which was acceptable in our survey form’s “Other” field for type of ownership. However, the others in that category had different preferences. Hence the shorthand with the asterisks.

Interestingly, RP doesn’t list its member practices online and declined our request for a roster. (Its website says it serves more than 1,000 facilities in 21 states.)

Meanwhile it isn’t always easy to figure out which investor group is involved with which practice or practices.

In one case a group had nothing on its website mentioning the parent company. The only thing giving away the connection was an email address in a “Contact us” box pointing to a known equity-based majority owner of radiology practices.

The stealth, whether intentional or inadvertent, could suggest that some practices identifying as physician-owned are, in fact, not entirely accurate in their self-assessment.

We take their word on their ownership and give everyone the benefit of the doubt when it comes to gauging transparency.

Regional Reach

Now to the aggregated responses presented in the accompanying charts and graphs.

By far the most common ownership structure is corporation. No surprise there. We didn’t ask entrants to specify C vs. S corporation, but the C type is standard and probably nearly ubiquitous among the 55% of practices identifying as corporations. A C corporation protects against business risks except for malpractice claims and protects personal assets from liability. An S corporation is limited to individuals and the owner gets a W-2 at tax time. Both types require malpractice insurance.

Apart from Other, the few variations of which are mostly handled on the list, the other named ownership types included general partnership (9%), limited liability partnership (3%), joint venture (2%) and limited partnership (1%).

It’s hard to picture a tiny practice still getting it done in this age of consolidation and value-based care, but a small yet meaningful 2% of practices identified as sole proprietorships.

Most practices in 2019 are serving patient populations spanning either an entire state (30%) or, even more common, a wider regional base (38%).

This year we asked for counts of advanced practitioners, our interest having been piqued by the many clicks earned online by RBJ’s “10 Things Radiologists Need to Know About Radiology Extenders” (April/May 2019). The counts ranged from a fairly common zero (18%) to a surprising 40 (3%). The most common headcount here was 2, reported by 20% of participants.

Also new this year was a question on employees dedicated to IT. Here zero was the most common answer (14%), with larger IT staffs popping up to the tune of eight (7%), 12 (5%) and 20 (3%).

The figures were similarly scattered for non-IT support staff. A brave 8% are making do with nobody at all to staff the front desk or keep the books, while that same percentage employ large support groups (20 to 30 people).

‘Do More With Less’

Many practices are branching out to provide ancillary services to other organizations. Quite close to half are offering IT or PACS services, with substantial numbers supplying management and consulting (34%), billing (28%) and/or office, real estate or property management. At the same time, nearly a third are not involved with any of the above.

As for pain points, one of the categories for which respondents could check off all that applied, anticipating new or increased pressures from private insurers topped the list at 51%.

Also bearing down on a lot of practices are pressures to keep current with technology (47%), avoid CMS payment penalties (46%), survive reduced reimbursement (46%), make the right moves around mergers and consolidations (45%), safeguard patient privacy and data security (43%) and prepare for the advance of AI (37%).

A practice executive in the Southwest likely spoke for many facing nearly all of the above when he or she wrote in: “We are in the process of looking to replace our RIS, PACS, voice recognition and VNA, so this will be a big year from an IT spend perspective. And all of this comes while we’re working to ensure the security of patient information. We are also negotiating more favorable contracts with insurance carriers to increase reimbursement and keep up with increased out-the-door expenditures.”

Radiology groups seeking growth “must be able to do more with less,” noted a respondent in the Southwest. “The successful ones are able to think outside the box to cut costs and increase value to our partners.”

Taking Charge of Change

Finally, in our free-text field inviting suggestions on questions for future efforts to size up radiology’s group-practice landscape, one respondent wrote in: “How are practices recruiting new radiologists during the current shortage?” Good timing. RBJ contributing writer Julie Chapman-Greene, PhD, MPH, takes on this very question here.

As for those future efforts at snapshotting said landscape, this year’s Exemplary 80 will serve as a reminder that radiology stakeholders and watchers alike need to keep eyes peeled for shifts in trends, strategies and priorities. The growing presence in the profession of not only Big Money but also Big Data—will we soon call it Big Radiology?—means change is upon us to a degree that couldn’t be foreseen when the first Radiology 100 rolled out in the mid-2000s. As RBJ noted in this space just one year ago:

“From mergers and acquisitions to joint ventures and other sorts of practice partnerships and fusions—not to mention hospital absorptions and investor gobble-ups—consolidation continues [apace]. The present disruption is a sign not so much of uncontrollable upheaval as of unbridled dynamism. Right now radiology practices would do well to stand atop medical history, shouting ‘Bring it on.’”

Now more than ever.