A dramatic shift: New survey highlights salaries and staffing concerns in radiology

Imaging leaders are living in a hyper-competitive market for talent in 2022, finding it difficult to fill physician, technologist and nurse positions, according to new survey data gathered by Radiology Business.

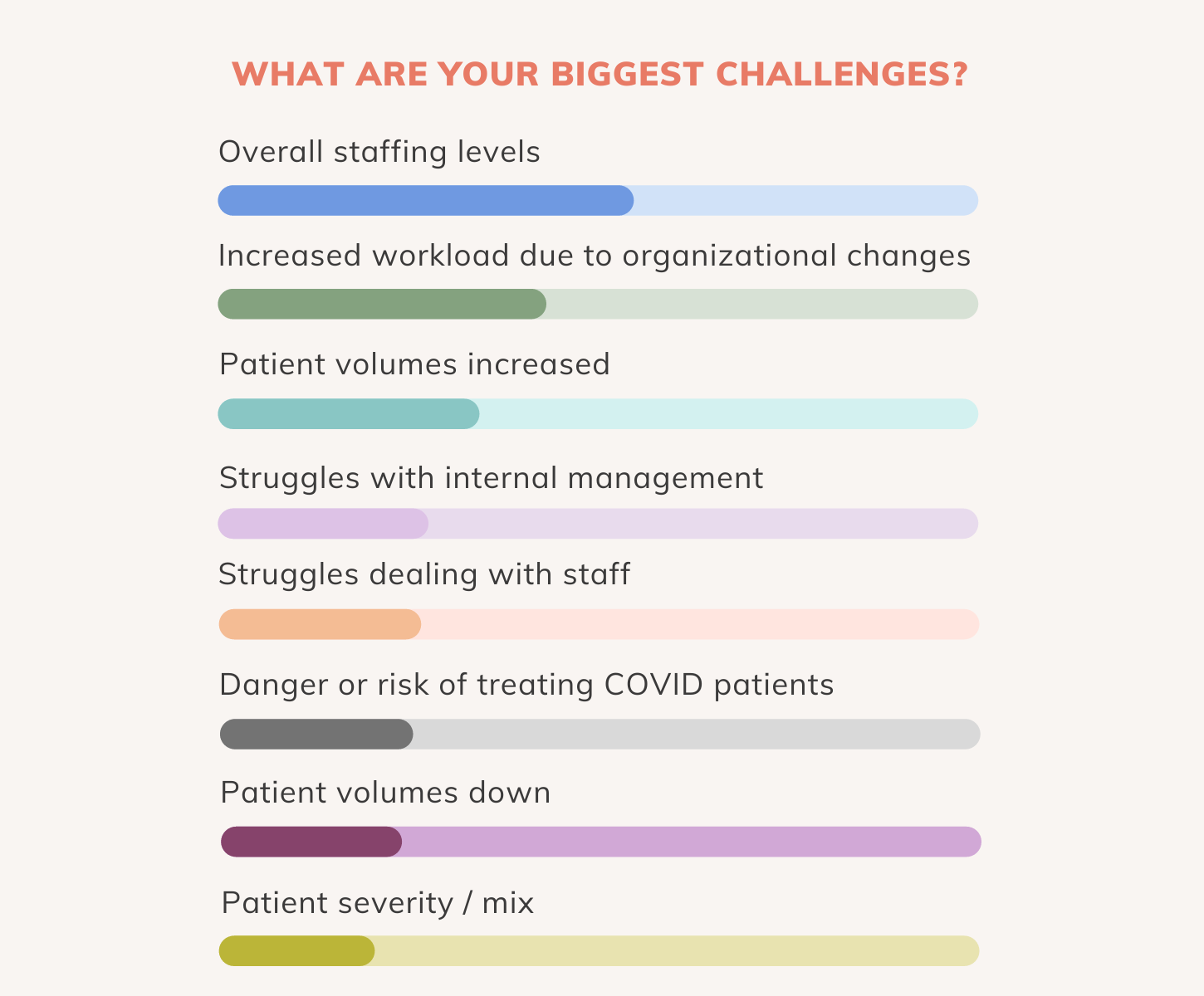

Across all titles surveyed—including administrators, radiologists, technologists, and IT and PACS managers—overall staffing levels were cited as the biggest challenge in the specialty by 55% of respondents. Amid hiring crunches, workplaces are forcing radiology staffers to assume additional duties too, with increased workloads due to organizational changes ranking as the No. 2 concern.

Case in point: Corvallis (Oregon) Radiology PC has been trying to recruit physicians in neuroradiology, breast and body imaging, along with an interventional assistant. However, the hiring process has been challenging, says longtime administrator Mark Kalmar. Prior to the pandemic, the private practice might receive upward of 40 responses to a job post. Now, they get fewer than five, with salary considerations 10% higher than anticipated.

“The landscape has changed dramatically in the last couple years,” says Kalmar, who is also president of the Radiology Business Management Association (RBMA) Board of Directors. “In our experience, there is a national shortage of radiologists.”

“The landscape has changed dramatically in the last couple years,” says Kalmar, who is also president of the Radiology Business Management Association (RBMA) Board of Directors. “In our experience, there is a national shortage of radiologists.”

High demand for physicians driving higher wages

In this frenzied hiring market, physicians are shopping around. About 28% of radiologists who chimed in on our survey say they are fairly compensated, but the great resignation and radiologist burnout are real. Some 35% of survey respondents tell us they’ve been applying to or considering new employment opportunities over the past year. Many may be only testing the waters, of course; 14% of those surveyed say it is somewhat likely they’ll change employers in the next 12 months while 9% say it is very likely.

Looking at the bigger picture, radiologists were the third most requested search by healthcare employers in 2021, behind only nurse practitioners and family medicine, according to physician recruiting firm Merritt Hawkins. The specialty was in high demand roughly 20 years ago, but saw a slowdown in the late 2000s. Now it is roaring back, with the Dallas-based physician recruiting firm witnessing a “feeding frenzy” for radiologist talent, says Michael Belkin, Merritt Hawkins’ divisional VP of physician and leadership solutions.

Whereas yesterday’s boom was fueled by hospitals gobbling up radiology groups to staff their own departments, private practices are driving demand in 2022. Belkin estimates hospitals represent less than 20% of Merritt Hawkins’ 2021 radiologist requests. National imaging organizations that previously created a market primarily for night-time reads and are now moving aggressively into the daytime hours. “This iteration [of demand] is very heavy private group practice,” Belkin says.

Out of 200 radiologists responding to our survey, 49% work in private practice. Hospital or health system clinicians represent the next largest portion of the pie at 26%, followed by university or academic institutions (15%) and medical groups (4%).

Meanwhile, radiologists who chimed in tell us they work for healthcare institutions of varying sizes. About 22% are part of an organization employing more than 500 physicians, with hospitals and academics accounting for the bulk of such answers. Another 19% said their workplace employs 10-25 physicians, tied for second with 26-50 providers (also 19%).

What is the average radiologist salary?

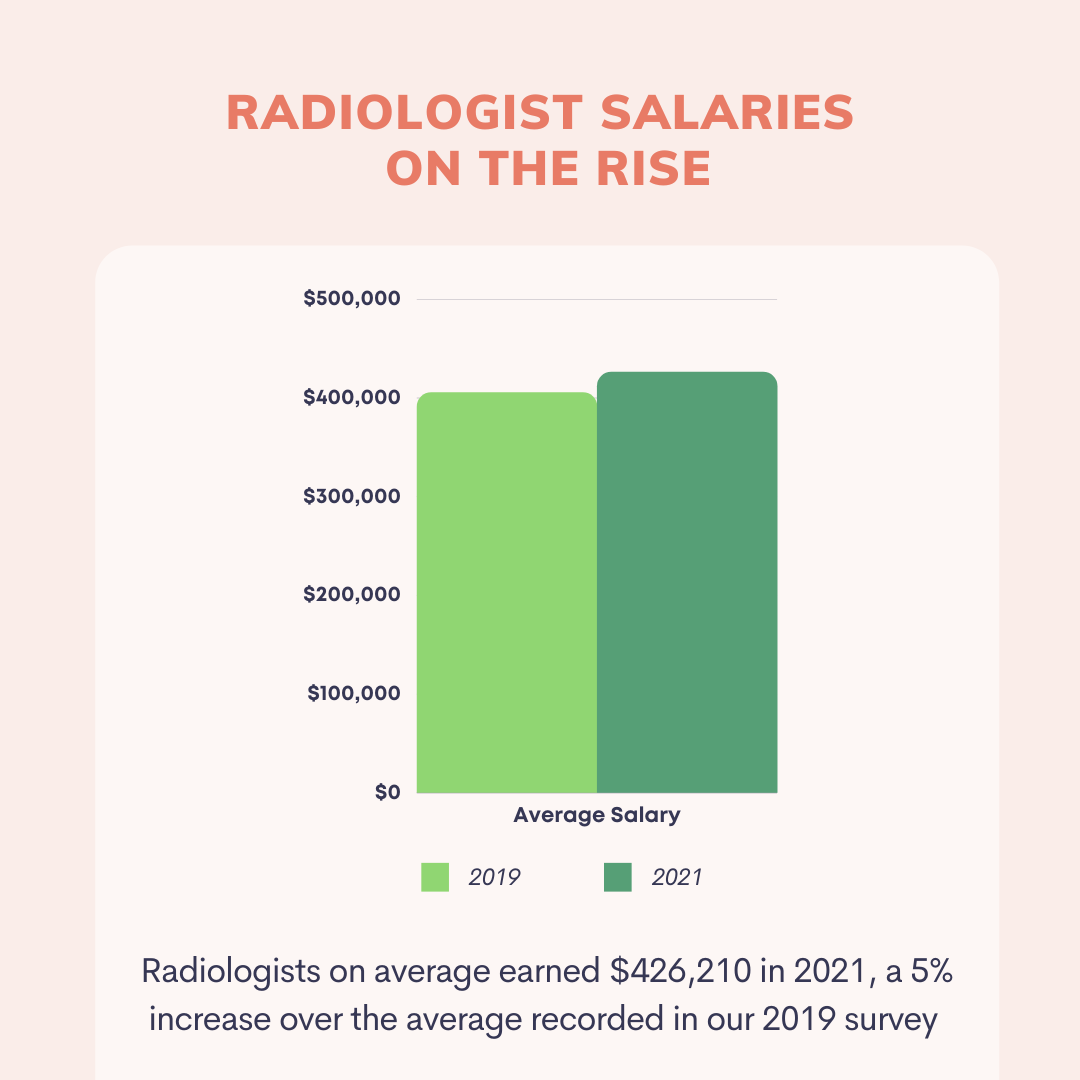

Radiologists on average were paid $426,210 in 2021, a 5% increase over the average recorded in our 2019 survey. Factoring in other pay sweeteners, members of the specialty tallied total compensation of $514,365, with a mean performance bonus of $124,522.

Demand differences may be reflected in respondents’ total compensation: Those working in private practice earned an average of $576,278 when factoring in one-time bonuses or profit sharing. That’s compared to $543,105 for radiologists operating in hospitals or health systems, $434,650 in academia, and $190,352 for physicians delivering care in freestanding imaging centers, our survey found.

Belkin notes there is a “very strong” private practice presence in radiology helping to fuel physician searches. Such specialists utilize a reimbursable skill set that does not necessitate hospital employment. While still facing some of the challenges of private practice, such as administrative costs, radiologists do not see large volumes of patients face to face, nor do their practices require the same staffing levels of primary care or other specialties. Imaging center ownership also is appealing, allowing practices to charge for the technical component of the CPT code and collect significant additional revenue.

“In today's market, it's so challenging to be a private practitioner that the majority of physicians are going to become hospital employees,” he says. “It's a much easier paradigm for them, and it's going to give them a much better quality of life because they just show up, do their job, and go home. Whereas in private practice, you have to run the books. You have to do all of the billing, the coding. With radiology, it’s simpler to be in private practice.”

Who is hiring in Radiology?

Recruiters in radiology appear to be stepping up their game to attract and retain talent in today’s market. About 35% of radiologists surveyed say they saw overall compensation increase during the past two years. Pay remained flat for 49% of radiologists, while 16% saw their paychecks shrink.

Among those who faced compensation cuts, COVID-related job losses, reduction in hours or drops in patient volumes were the most popular cause, cited by 63% of respondents. About 43% of radiologists reached in our survey believe they’ll never return to pre-pandemic pay levels; while 29% said it should happen in the next year, 21% expect they’ll be made whole within the next two to three turns of the calendar.

Of the radiologists who did receive a raise, 26% said their latest pay bump totaled 5% to 7%, the most common answer. Another 23% estimated their latest increase was between 2% and 4%, and the same number of respondents received an uptick of less than 2%.

The majority of radiologists surveyed (68%) say their compensation includes a salary or salary plus incentives. The latter guarantees a minimum base pay, supplemented with additional rewards for productivity and other accomplishments. Another 21% of rads say their compensation is all or mostly tied to productivity; 8% are paid based on a split between productivity and quality of care (mostly in the hospital/health system setting at 20%); and the final 3% answered, other. The salary or salary-plus model dominated across hospitals, private practices and academia, with all hovering between 60% and 70%. Radiologists working in independent or freestanding imaging centers were the only segment where 50% said they’re paid all or mostly based on productivity, while 20% of private practice and hospital providers received all or most of their pay tied to output.

Incentive pay is one area where practices models diverged. More than 40% of radiologists in our survey say they received a cash bonus in 2020; about 38% collected zero bonus that year; 27% had some form of profit-sharing; and about 9% had a bonus tied to retirement.

The entirety of such retirement sweeteners, stock options and profit-sharing were received by private practice physicians, according to our survey. None of the radiologists working in freestanding centers say they received a bonus, as was the case with more than 40% of private practice-, hospital- and academia-based docs.

Belkin urges radiology organizations to know what they are offering before going to market and consider making at least some component of doc pay salaried. Not that long ago, “pay per click” or “eat what you read” models were common ways of compensating radiologists. But today, he says, members of the specialty “are shying away.”

“Even for nighthawk radiology, radiologists want a guarantee of some sort,” he said. “They don’t want pay that is contingent upon what comes to them on that read list. They want to know there is going to be some level of salary and then some type of a bonus based on productivity.”

Belkin also advises practices and hospitals seeking to replace a departing radiologist — with generalized skills and an expertise in multiple modalities — to consider hiring multiple providers in their place. Oftentimes, groups are seeing retirement arrive for older radiologists who can do a little bit of everything, from reading mammograms to handling whole-body MRI studies or performing various interventional procedures. But many early career rads are coming out of training as highly honed subspecialists and may not be able to function as jacks-of-all-trades. His comments echo a 2020 JACR analysis, which found that the number of generalists in radiology has dropped in recent years.

Belkin also advises practices and hospitals seeking to replace a departing radiologist — with generalized skills and an expertise in multiple modalities — to consider hiring multiple providers in their place. Oftentimes, groups are seeing retirement arrive for older radiologists who can do a little bit of everything, from reading mammograms to handling whole-body MRI studies or performing various interventional procedures. But many early career rads are coming out of training as highly honed subspecialists and may not be able to function as jacks-of-all-trades. His comments echo a 2020 JACR analysis, which found that the number of generalists in radiology has dropped in recent years.

Radiologist Ivan DeQuesada, MD, who helps oversee recruiting for one of Texas’ largest imaging groups, says practices need to be flexible and take an “a la carte” approach to hiring. Each candidate will come with a unique ask. Some will want to work remotely. Others will want days only, a sign-on bonus, training stipend, or shorter partnership track. In previous years, practices may have been choosy and weigh whether a physician is a good group fit. Not anymore.

“We are really hurting to keep pace with natural growth,” says DeQuesada, a neuroradiologist with Radiology Associates of North Texas (RANT) and member of Strategic Radiology. “There are just fewer people to interview and almost every one of them has to be considered a serious contender. Groups just cannot be as selective anymore. Things have changed dramatically in the short time that I've been running recruitment at RANT.”

Radiology Partners has sought to fill several physician roles recently, with breast, interventional and general subspecialists topping the list. The El Segundo, California-based industry giant has tried to be creative in meeting its many needs, says Arthy Saravanan, MD, associate chief medical officer of recruitment. Tactics have included targeting people who grew up in certain geographies to fill rural roles and offering more flexible options such as remote reading and part-time work.

They’ve also encouraged local practices to follow national trends in compensation: doling out more sign-on bonuses to lure radiologists into less desirable locations and offering higher referral amounts for difficult-to-fill physician roles. Some Rad Partners practices located in overlapping markets such as Houston also are encouraged to share the time and salaries for scarce specialists. Teleradiology giant vRad, also part of Rad Partners, recently increased its physicians’ compensation by up to 25% in a bid to boost hiring and retention. That clearly reflects the need to increase salaries to attract and retain good radiologists.

Of the radiologists surveyed, only 8% say their compensation is split between productivity and quality considerations. Another 36% say their most recent bonus was tied to value, while 64% did not. Saravanan says Rad Partners has tried to keep “close tabs” on quality amid hiring challenges and has launched several improvement projects. Whether a RP member group ties bonuses to quality is dependent on each practice, which has leeway to dictate such details.

“We have several devoted physician leaders across the practice who focus on quality,” Saravanan says. “Even with this growing difficulty in staffing, we want to ensure that patient care is our top priority.”

Value-based compensation has been slower to take hold in the specialty, according to Belkin. The most recent survey data from Merritt Hawkins found that fewer than 36% of radiologists indicated that any part of their compensation was linked to quality metrics such as patient satisfaction or outcomes. That’s compared to more than 47% across all physicians. Diagnostic radiologists typically don’t interact with patients, making it more difficult to measure satisfaction, and they also aren’t dictating treatment plans but conferring with referrers who do.

“Value-based compensation, capitation and utilization management have not been a huge focus in radiology,” he says, adding that bundled payment projects are one area where quality is taking hold more rapidly.

Radiology administrator pay flat

While radiologists saw noteworthy gains since our 2019 survey, imaging administrator pay stayed about the same. The position earned an average salary of $129,043 in 2021, about the same as the $130,643 figure survey takers told us three years ago.

Mean bonus came in at about $14,072, according to our latest data, for a total average all-in compensation of $140,723. About 40% of respondents say they did not receive an incentive in 2020, while more than half collected a cash reward. A small number of respondents also received a sign-on bonus, trips, or other perks.

About 32% of radiology administrators say their overall compensation has been flat during the past two years; 66% say it went up, and just 2% saw a drop (with COVID-19 cited as the primary reason). Among those who did get a raise, 2% to 4% was the most popular answer, shared by 76% of respondents.

Nearly 80% of administrators say their compensation is salary based, with a split between productivity and quality/value the next most popular answer (16%). Only 2% say their wages are all or mostly tied to productivity. In contrast to radiologists, 68% of administrators say their bonus is based on quality (32 percentage points higher than rads), and 32% of admins say value has no influence on their incentives.

Sixty percent of radiology administrators feel fairly compensated in their role, with 40% sharing that they are not. That mirrors the next question in our survey, which shows the great resignation is top-of-mind among radiology administrators. Some 40% of respondents say they spent time applying to or considering a new employment opportunity versus 60% who did not. Only 4%, however, believe it is very likely they'll change employers during the next year. Thirty-three percent say it is somewhat likely, and 63% don’t see it happening anytime soon.

So what do radiology administrators see as their top challenge? Staffing levels, as one might expect, were cited as the No. 1 challenge, according to 75% of respondents. Increased workload due to organizational changes is No. 2, with struggles dealing with staff coming in third.

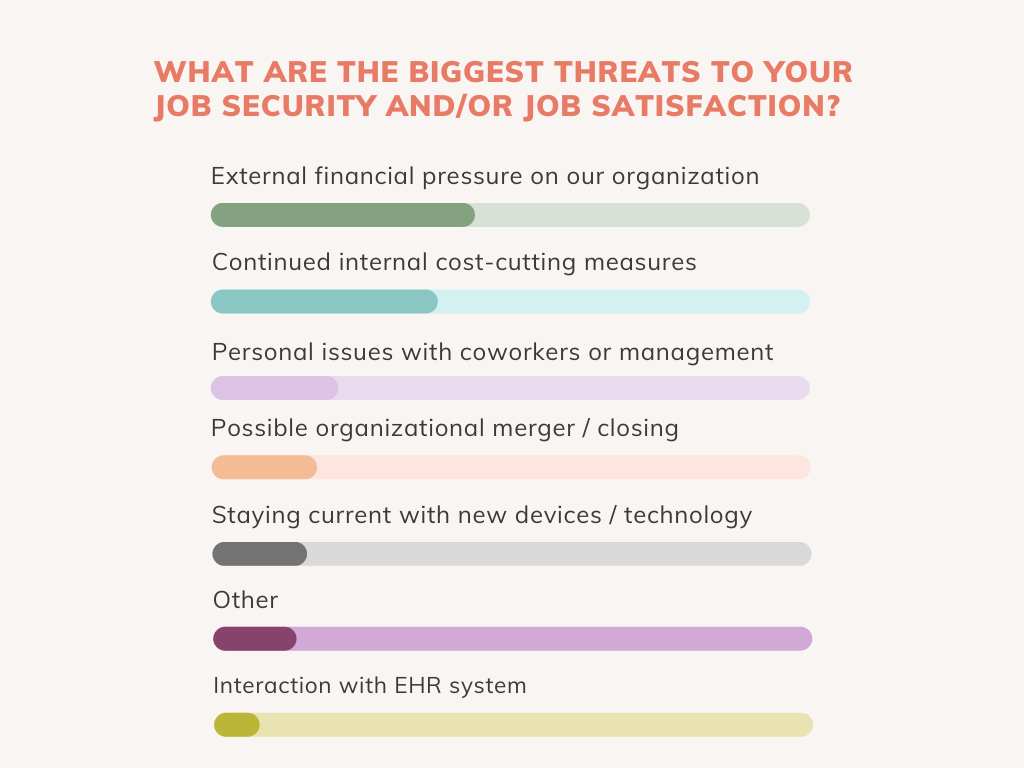

Asked to pinpoint the greatest threat to their job security and professional satisfaction, nearly 46% of administrators cited external financial pressure on our organization. Continued internal cost-cutting measures was second on the list, followed by possible organizational merger or closing.

Alongside radiologists, mammography technologists and other roles, Rad Partners has faced challenges filling administrator positions. With candidates driving the market, imaging organizations are struggling to retain or unearth new leadership talent, while job seekers have sought to leverage this landscape to gain additional perks during hiring, Saravanan says.

“Many [administrators] want something extra in their next role, whether it is increased compensation, more PTO hours or having the flexibility to work remotely when needed, if they have to be on-site in an office,” she says.

Currently, RP has 43 program directors who serve in the radiology administrator role. Top reasons for seeking a new position, Saravanan says, include wanting to work remotely after being required to return to an office, or seeking more job security and longevity. Many administrator candidates have relayed that they value a position that is long-term and stable over something seen as the “best next step” in their career.

When it comes to describing the most rewarding part of being a radiology administrator 40% of respondents say working with a great team. Other popular answers include being very good at what I do and making the world a better place by helping others.

Imaging leader Kimlyn Queen-Weis, MBA, has been seeking to fill an administrator in her organization for a few months. She says the search has been subject to some of the same challenges seen when seeking other positions such as technologists, front-line managers and associates. Provider groups have pivoted to combining multiple admin roles into one to help fill gaps. At OhioHealth system in Columbus, where she is director of system imaging, leaders merged the admin role overseeing oncology and radiology services.

Oftentimes in 2022, imaging directors are asked to pilot multiple departments. Technologists and nurses frequently ascend to administrator, she adds, and challenges filling such roles is “absolutely” having a domino effect on management hires.

“There are a lot of different types of people coming into the imaging space now and leading radiology departments who didn’t traditionally fill that role 10 years ago,” says Queen-Weis, who has worked at OhioHealth for 32 years and is also president of AHRA’s Board of Directors. “The leadership landscape has really changed.”

Related Radiology Compensation Content:

RBMA radiology administrator compensation survey expands insights during the great resignation

Radiologist pay hits $437,000, good for 8th place among highest earning physician specialists

Radiologists among top 10 most recruited physicians as hiring demand shifts to specialty care

Radiologists often aren’t credited for 2nd opinion reads, despite the increased workload

Radiologists among the most in-demand health workers, earning No. 5 highest starting salary

Female radiologists earn nearly $1M less than males during a 40-year career

Radiologists the 7th best-paid medical workers, biz mag finds

Technologist salary survey shows raises across all practice areas

A dramatic shift: New survey highlights salaries and staffing concerns in radiology

Radiologists’ $401,000 starting salary lands specialty in the top 5

Radiologist pay hits $437,000, good for 8th place among highest earning physician specialists

Radiologists among top 10 most recruited physicians as hiring demand shifts to specialty care

Radiologists’ $427K salary places specialty in top 5, though COVID may take a bite

Radiologist salaries slide to $413,000 as specialty among those hit hardest by pandemic