Radiology the 3rd most sought-after specialty among healthcare employers

Radiology is the third most sought-after specialty among healthcare employers, according to a new report from recruiting firm AMN Healthcare, officially released Monday.

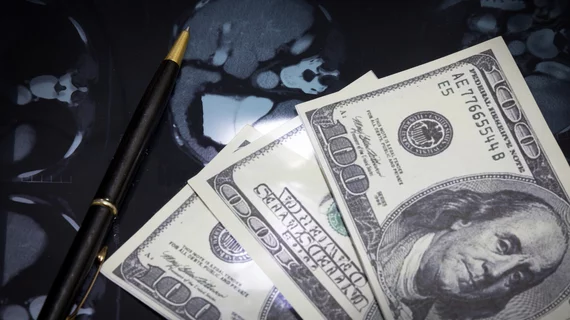

The Dallas-based company received 155 search requests for such specialists, behind only physicians in family medicine (279) and nurse practitioners (420). Radiologists recorded an average signing bonus of $82,826 during that timeframe—higher than NPs ($8,976) or family docs ($45,918)—with some rads recording sign-on incentives as high as $570,000, AMN reported.

Radiologists are earning an average annual salary of $472,000, the analysis found, up 4% from AMN’s previous 2021/2022 report. Psychiatrists saw the largest gain, rising 19% to $355,000. A growing array of healthcare organizations is competing for physician talent and choosing from a limited talent pool. Talent seekers include private equity firms, retail clinics, urgent care centers, telehealth platforms and insurance companies, according to the report.

“Rising physician starting salaries are a clear sign that demand for physicians is surging,” Leah Grant, president of AMN Healthcare Physician Solutions, said in an Aug. 14 announcement from the company. “Healthcare is evolving as new market entrants seek to change how and where care is delivered,” she added later. “More types of organizations are recruiting physicians, causing salaries to trend up.”

Academic medical centers also are fueling competition for physician talent as these hubs for specialty care experience rising demand for procedures and other clinical services. Radiologists represented the No. 2 most requested search among AMCs, behind only anesthesiologists. However, recruiters are facing challenges, as the average starting salary for a radiologist in academia ($424,000) is nearly 12% lower than those in other settings ($481,000), AMN Healthcare reported.

Such centers often require work on less desirable nights and weekends, further exacerbating their recruiting challenges.

“Demand for anesthesiologists, [certified registered nurse anesthetists] and radiologists underscores the growing role of AMCs as clinical care providers and the rising number of medical procedures performed at AMCs, almost all of which require radiology and anesthesiology,” the report noted. “Radiology and anesthesiology are difficult to fill searches on behalf of AMCs given high patient acuity, high demand and the fact that AMCs rarely can match the compensation offers made by other settings, as the numbers [above] suggest.”

The average starting radiologist salary of $472,000—which includes base salary and guaranteed income only, and not bonus or benefits—represents a more than 27% increase from AMN’s 2017/2018 report. A regional breakdown of the data shows radiologists earned the highest average starting salary in the Midwest ($495,600) and lowest in the Southeast ($438,622).

Radiologists were No. 5 in “absolute demand,” meaning if professions were ranked by number of search engagements/job openings as a percent of all active providers in a given specialty. This figure helps account for specialties that have a comparatively high number of practicing physicians, such as family medicine, which may generate a comparatively high number of searches. Pulmonology ranked No. 1 on this list, followed by gastroenterology, hematology/oncology and urology.

In absolute demand, family medicine fell all the way to No. 14 on the list. AMN Healthcare noted that demand for primary care has cooled in recent years. About 64% of its searches were for medical specialists during the previous 12 months, versus just 17% for PCPs. Meanwhile, physician assistants and nurse practitioners accounted for the other 19%, with NP continuing as the top search for three years in a row.

“The rapid expansion of the NP workforce, which now includes 355,000 professionals, has been critical to ameliorating the physician shortage,” the report noted. “Convenient care venues such as retail clinics, urgent care centers and telehealth platforms built their delivery models around NPs and PAs before expanding into physician-based services. These venues continue to be active in AP recruiting.”

AMN Healthcare’s 2023 Review of Physician and Advanced Practitioner Recruiting Incentives is based on a representative sample of the 2,676 search engagements the company conducted from April 1, 2022 to March 31, 2023. You can read the whole report for free here.