Nanox hit with class action lawsuit amid criticism labeling imaging startup as ‘Theranos 2.0’

Nanox Imaging has been hit with a class action lawsuit amid recent criticism labeling the startup as “Theranos 2.0,” in reference to the spectacular failure of the once-promising blood-testing company.

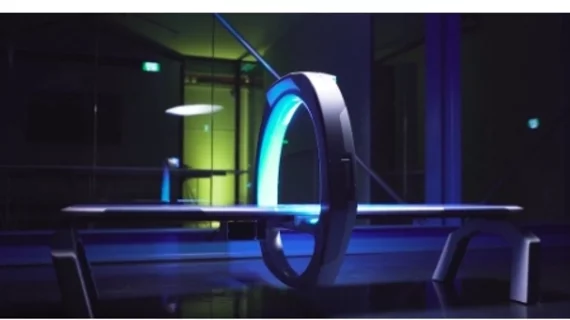

The news comes just weeks after the Israeli firm completed a successful initial public offering that raised $190 million. Nanox has inked a series of deals in several countries to provide its novel imaging system, claiming to offer high-end medical imaging at a fraction of the cost and footprint. But analysts at Citron Research raised red flags Tuesday, Sept. 15, claiming the company is merely a “stock promotion” amassing millions without any FDA approvals or scientific evidence.

Citron’s analysis—titled “A Complete Farce on the Market: Theranos 2.0”—drew widespread attention, with several law firms soliciting investors looking to sue Nanox over its claims. Plaintiff Matthew White and law firm Rosen Law are one of the first to follow through, filing a proposed securities class action in New York on Wednesday.

He claims the company made false statements to both the SEC and investors to inflate its stock value, Bloomberg Law reported. White and his attorneys also allege Nanox fabricated commercial agreements and made misleading statements about its imaging technology. Several other law firms also announced their own lawsuits on behalf of investors Friday.

Nanox did not respond to a Radiology Business request for comment. However, the Neve Ilan, Israel-based company posted a statement to its webpage Wednesday, Sept. 16, addressing the “unusual trading activities” after investors dumped the stock en masse in response to Citron’s concerns.

Officials said the report “contains factual errors and misleading speculations,” but they did not elaborate in the announcement.

“Nanox believes that the allegations in the report are completely without merit and strongly condemns the publishing of the false and misleading information contained in this report,” the statement read. “The company is carefully reviewing the report and will provide additional information on the allegations as appropriate.”

Meanwhile, others have criticized Citron and founder Andrew Left of manipulating the market and misleading investors for their own gains. A Change.org petition circulating this week urged the SEC’s Division of Enforcement to investigate Citron’s actions.