The impact of Trump tariffs on iodine contrast media costs

The fragile and internationally interconnected nature of the healthcare supply chain was thrust into national headlines in 2022, when U.S. hospitals had to start rationing iodine contrast and delay nonessential imaging exams due to Chinese imports coming to an abrupt stop. There are now questions whether the current tariffs might similarly raise the cost of contrast across the U.S., but GE HealthCare does not expect to see an impact.

GE's largest iodine contrast production facility in Shanghai, China, was shutdown for a couple months due to Chinese authorities attempting to quarantine the city and stop an outbreak of COVID-19. The temporary closure sent ripples through the healthcare supply chain that led to rationing of iodine contrast used in CT scan and interventional cath lab procedures. Radiology departments and heath systems were put in a disaster-like situation that was completely unexpected.

GE HealthCare estimated the price of iodine raw material increased by more than 200% between 2017 to 2023, with costs of energy, freight and labor also increasing. But, GE does not expect Chinese tariffs to impact the overall costs of its contrast because the company has taken steps since the 2022 shortage to mitigate the impact of future supply chain disruptions.

In the aftermath of the iodine shortage, GE responded in the fall of 2022 by pledging to expand its iodine contrast production at other facilities around the globe. In November 2022, GE announced an $80 million investment to expand its contrast production capacity at its pharmaceutical ingredient facility in Lindesnes, Norway. The vendor said the facility would boost production 30 million additional doses of contrast media per year by 2025. This was in part to address future supply chain disruptions, but GE also said there has been growing demand for contrast media, which it expects to double in the next decade.

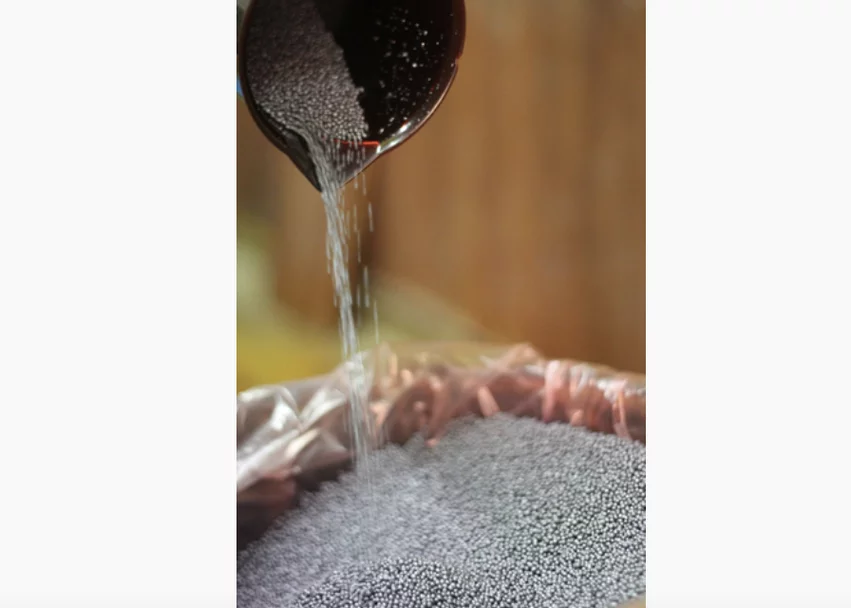

In October 2022, GE HealthCare also signed a multi-year supply agreements with SQM, a Chile-based mining company, and other vendors in Japan to secure an increased supply of iodine for contrast production. The company also announced an additional investment to expand capacity at its secondary manufacturing fill and finish sites to increase patient doses by this year.

Last month, GE announced a $138 million investment in its Cork, Ireland, iodine contrast manufacturing facility to meet increasing demand. The expansion of the factory site will enable production of an additional 25 million patient doses of contrast media per year by the end of 2027. The company is expected to break ground on the expansion project this month.

GE said in 2024, the Ireland facility, along with GE HealthCare’s other production sites in Shanghai, China, and Oslo, Norway, supplied more than 100 million patient doses of contrast media around the world.

The new facility—which will support both established and pipeline products—will include solution preparation vessels, multifunctional powder handling systems, a new filling line and autoclaves, with advanced automation systems underpinning production. Once established, the additional capacity will cater to the growing global demand, while offering increased flexibility and resiliency across GE HealthCare’s contrast media production network.

"This new facility demonstrates our broader commitment not just to address future demand, but also to increase resiliency and security of industry supply for customers,” Kevin O’Neill, president and CEO of GE HealthCare’s Pharmaceutical Diagnostics segment, said in a statement.

GE HealthCare's top priority is to make sure patient and customer deliveries for products and services are not interrupted under any circumstances, including tariffs. GE said the Cork plant expansion and increased production in Norway should compensate for U.S. Chinese made contrast imports.

"Our teams have been, and will continue to, proactively work on potential mitigation plans in our supply chain operations. Beyond that, at this time, it's too early to comment on the specifics," GE said in a statement to Radiology Business about the possible cost impacts of the Chinese, and possible Mexican and Canadian, tariffs.

Higher contrast costs could have a big impact health systems

While GE said there will not be an issue with price increases from Chinese tariffs, some in radiology have concerns about the possibility, including the Radiology Business Management Association (RBMA). The group said it has seen iodine contrast prices rise prior to and since the pandemic.

To quantify the potential for increased costs from tariffs, consider Medicare patients alone accounted for 10.16 million contrast CT exams in 2023 in the United States. This includes 40 different CPT codes for contrast CT. Larger healthcare systems that buy vast quantities of contrast have an average cost in the neighborhood of about $30 per patient dose. In ballpark figures, if a large amount of U.S. contrast supply was still coming from China, as was the case in 2022, it would translate into a price increase of about $3 per dose. The cost increase for Medicare patient contrast scans could increase nationwide by $30.5 million using those numbers.

However, the cost of contrast to start is higher for smaller health systems and radiology practices, so costs could be higher. While this math is hypothetical, the concern in the industry is real.

"I don't know how providers will absorb these costs. We can't just raise prices because we have contracts with insurance providers and we have fixed reimbursement rates from Medicare," said Kit Crancer, an RBMA board member and senior vice president of public policy for Rayus Radiology.

He said Rayus and RBMA will likely pursue advocacy efforts with Congress and the Trump administration to seek tariff exemptions for medical supplies. That advocacy is already underway with some other groups. Read more in the article—Imaging lobbying group wants medical devices exempt from Trump tariffs.