Private-equity radiology group owner Grovecourt Capital acquires MRI solutions provider IMRIS Imaging

Grovecourt Capital Partners—a private equity firm that recently bought telerad outfit Premier Radiology Services—is growing its medical imaging portfolio with another acquisition.

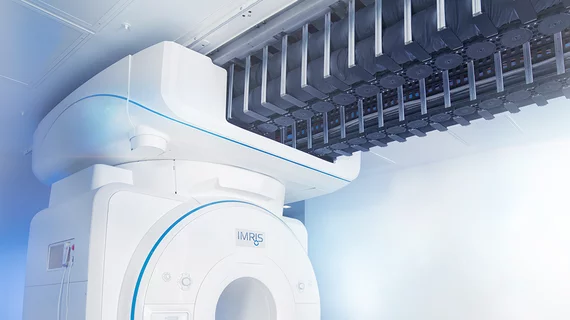

The West Palm Beach, Florida-based investment group is adding IMRIS Imaging Inc. to its roster for an undisclosed sum. Founded in 2005, the vendor designs, manufactures and services a proprietary intraoperative MRI suite.

Hospitals and cancer centers across the globe use its products, with over 70,000 patients serviced by IMRIS’ image-guided therapy solutions.

“As seasoned investors in the medical imaging space, we are thrilled to partner with … the entire IMRIS team to drive innovation, expand the company’s products and services and enhance patient care,” Matt Bergin, managing partner at Grovecourt Capital, said in a statement Feb. 19.

Chaska, Minnesota-based IMRIS provides what it believes is the only movable MRI that operates on a ceiling-mounted rail system. It “seamlessly” glides between diagnostic suites and operating rooms, “bringing the MRI machine directly to the patient.” Grovecourt noted that the technology helps neurosurgeons and other physicians enhance precision while reducing the need for follow-up MR imaging and surgical procedures.

“This partnership with Grovecourt will enable us to enter a new phase of growth and accelerate IMRIS’ mission to improve patient care through innovative intraoperative technologies,” radiologist Gregory Sorensen, MD, executive chairman of IMRIS and chief science officer for RadNet Inc., said in the announcement. “We are so excited for this partnership and the opportunities ahead,” he added.

IMRIS filed for Chapter 11 bankruptcy protection in 2015 and was acquired by the Deerfield Management investment firm the same year. The company had previously gone by the name IMRIS Deerfield Imaging.