Radiology 100: Moving forward

Read the full Radiology 100 rankings here.

The Tenth Annual Radiology 100 Finds Practices Choosing One of Two Paths: Hire Additional Radiologists or Consider Consolidation

The first thing that leaps out about this year’s Radiology 100—our tenth annual ranking of the largest private radiology practices in the United States—is its similarities to last year. The top five largest practices are the same as in 2016, but in a slightly different order. Continue through the rankings and you’ll notice that a vast majority of the practices listed in 2017 were also featured last year, though some new practices did emerge in the last 12 months. This year’s ranking also confirms that the growth in practice size we saw in 2016 was no fluke. The average size of a ranked practice, for instance, was 52 FTE radiologists in 2015, 53.5 in 2016 and is now 56.5 in 2017.

Rules of the Rankings

A quick note about how we put together this ranking: The Radiology 100 survey was placed online at Radiology100.com and emailed to previous participants and other key players throughout the medical imaging industry. Additional emails and phone calls were placed to clarify facts when necessary. Survey questions covered practice size, the total number of procedures performed and concerns about the industry. Some fields were required to be considered for this ranking while other fields were optional. We received hundreds of submissions and appreciate the time leaders from throughout the country took to participate in our survey.

The Radiology 100 ranking is determined by each practice’s total number of FTE radiologists. Only private radiology practices, with no outside investment from private equity or other sources, were included in this ranking. As in previous years, when a practice’s number of FTE radiologists was counted on its website, that total was reduced by 5 percent to account for the presumed discrepancy between FTE numbers and total head count. When there was a tie, each practice’s total number of FTE employees was taken into account to determine the final ranking.

Meet the Top Five

You may recognize some familiar names at the top of our latest ranking, beginning with the very top. Radiology Associates of North Texas out of Fort Worth, Texas, is once again the largest private radiology practice in the country with 180 FTE radiologists. The practice, which also provides its services to 32 hospitals, held the No. 1 spot in 2016 with 164 FTE radiologists and added an additional 16 radiologists along the way.

Radia of Lynwood, Wash., comes in at No. 2 this year with 157 FTE radiologists. A year ago, Radia was No. 5, but climbed three spots thanks to adding another 55 radiologists in the last 12 months. Radia also provides services in four states and has an ownership interest in three imaging centers.

Advanced Radiology Services of Grand Rapids, Mich., holds the No. 3 spot for the second consecutive year with 122 FTE radiologists. Though the ranking remains the same, the practice has been far from stationary; it now employs 14 more radiologists than last year. Advanced Radiology Services provides services to 18 hospitals.

Phoenix-based Southwest Diagnostic Imaging comes in at No. 4 with 117 FTE radiologists. Much like Advanced Radiology Services, Southwest Diagnostic Imaging holds the same place in this year’s ranking as it did in 2016, though the practice does now employ 13 more radiologists. In addition, Southwest Diagnostic Imaging provides services to 19 hospitals and has an ownership interest in 31 imaging centers.

After holding the No. 2 spot for two straight years, University Radiology in East Brunswick, N.J., is No. 5 in 2017 with 112 FTE radiologists. This marks the practice’s third straight finish in the Radiology 100 top 5. University

Radiology serves patients in 5 states, provides services to nine hospitals and has an ownership interest in 20 imaging centers.

Continued Growth and Consolidation

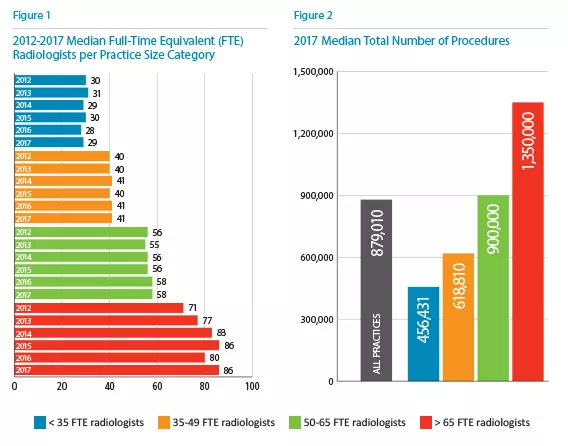

While the average practice size increased yet again in 2017, the median number of FTE radiologists in larger practices also saw a jump (Figure 1). Practices with more than 65 radiologists had a median of 80 on staff in 2016, down from 83 in 2014 and 86 in 2015. This year, however, the number is back up to 86.

There’s another key statistic this year that shows evidence of private practice growth: the actual number of practices that employ more than 65 FTE radiologists. Back in 2009, we listed eight such practices in our ranking, but that jumped to 20 in 2015 and then 26 in 2016. This year, that number increased yet again to 28 practices with more than 65 FTE radiologists.

This growth is a clear sign that the largest private practices in the U.S. are thriving. To move up in our rankings, groups had to have added additional radiologists to their staff over the last year. Due to the growth of so many other practices, if a group's number of FTE radiologists remained the same, it likely resulted in a drop down the list.

While the number of radiologists at practices rose, the median number of procedures saw a drop for three of the four practice size categories (Figure 2). The only increase in procedures was seen for radiologists with 50 to 65 FTE radiologists—that group performed a median of 880,118 procedures in 2016 and 900,000 in 2017.

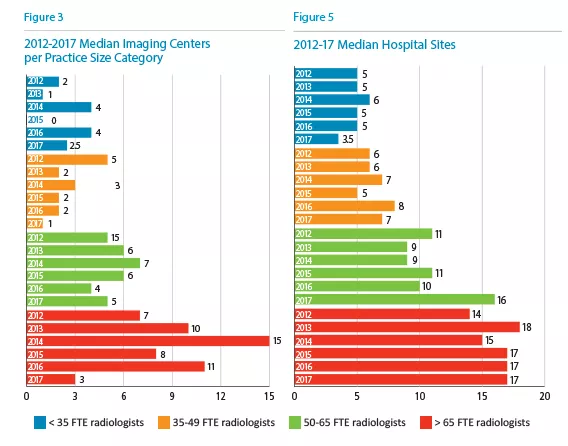

One truly eye-opening statistic from this year’s Radiology 100 is the number of imaging centers in which private practices had an ownership stake. The median number of imaging centers dropped significantly for every practice size category (Figure 3). For practices with more than 65 FTE radiologists, the number of imaging centers went from 8 in 2015 and 11 in 2016 to 3 in 2017. What led to this figure falling so fast? The consolidation of private practices and the consolidation of outpatient imaging centers. It’s important to note that the median number of hospital contracts did not share a similar fate (Figure 5). Hospital contracts for practices with more than 65 FTE radiologists held steady at 17 for the third year in a row, and the median for practices with 50-65 FTE radiologists bumped up from 11 in 2015 and 10 in 2016 to 16 in this year’s ranking. The groups with fewer than 35 radiologists and 35-49 radiologists did drop, however, showing that consolidation is still impacting the relationships between hospitals and smaller private practices. Next year’s data should be especially intriguing; will the larger private practices keep picking up more contracts while smaller practices keep losing them?

But we’re all watching the trending of consolidation. Does it mean the eventual end for private radiology practices? Not so fast, says David Phelps, MD, president of No. 1-ranked Radiology Associates of North Texas. Bigger private equity-backed radiology groups might be thriving at the moment, he says, but they will never completely run the market. Phelps notes that private equity-backed groups can’t compete with private practices on radiology salaries, meaning they won’t be able to attract the best of the best. In addition, he adds, those groups simply don’t have the radiologist know-how needed to provide high-quality patient care.

“Ultimately, patients are best cared for when the physicians who provide their care are in control of all aspects of their practice environment and are fully involved in making the decisions which affect patient care,” Phelps says. “In theory, it is easy to talk about ‘non-patient care’ management decisions separately from those that directly affect patient care. In reality, the distinction is often much less clear, and radiologists are in the best position to make those decisions in a manner that is in the best interest of their patients.”

Exploring the Data

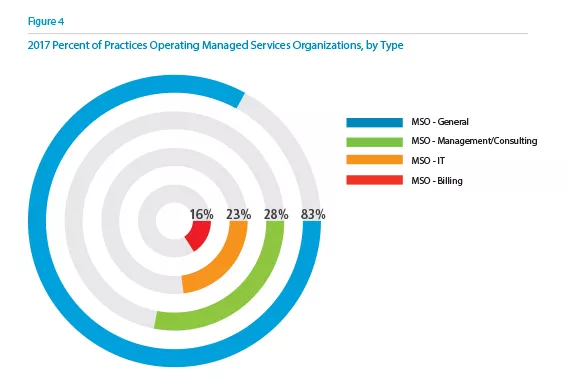

Diving a bit deeper into the survey responses, it seems that managed service organization (MSO) participation is on the rise, though specific services saw a swift decline (Figure 4). Overall MSO participation among private radiology practices surged from 62 percent in 2016 to 83 percent this year, a boost that shows radiologists working hard to collect ancillary income for their groups. Participation in IT MSOs, however, dropped from 43 percent in 2016 to 28 percent this year. Management and consulting MSO participation (46 percent to 23 percent) and billing MSO participation (33 percent to 16 percent) also dropped. It’s unclear if this is yet another side effect of the industry’s growth and consolidation or if reflects a trend in MSO distribution more than anything about the practices themselves. With overall participation at more than 80 percent, though, it’s clear that practices are still open to looking outside of the organization for help in key areas as opposed to completing everything internally.

Big Thoughts on Big Issues

Numbers are top of mind to practice leaders, but here's what keeps them up at night. It’s no surprise that money is the biggest issue, with two-thirds of the survey base identifying the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) or other declining reimbursement as a top concern. Consolidations and mergers came in at No. 2 (63.6 percent), and data security was No. 3 (62.1 percent). Staying up to date on advanced technologies (45.5 percent) and advances in deep learning and artificial intelligence (AI) (33.3 percent) rounded out the top 5. While it was no surprise to see MACRA at the top spot, deep learning/AI only being chosen by one-third of the practices was unexpected.

Keys to Success

So what can private radiology practices do to improve their chances of success in the years ahead? Linda A. Wilgus, CPA, CMPE, executive director and chief financial officer of Northwest Radiology Network in Indianapolis (ranked No. 43 this year with 52 FTE radiologists) points to the importance of investing in the health IT side of your practice. If you don’t, she warns, you risk being unable to provide the same quality of care as your competition.

“You have to have IT platforms and a level of sophistication that allows you to provide that high-quality care,” Wilgus says. “If your pediatric cardiology radiologist needs to read this cardiac MR and he or she is sitting in another facility, you have to be able to get that image over there for that person to read.”

The need for such investments shows one reason so many of today’s private practices are consolidating. Wilgus adds that she still firmly supports “the physician-owned, physician-led concept,” but at the end of the day, practices do what they have to do to be able to compete.

“To invest in this, you have to have some size and scope,” she says. “The independent private practice of radiology is going to have to amass some size and scope to compete on the national level and provide high-quality subspecialized reads that lead to better outcomes and better costs. That’s where we’re at in this healthcare environment.”

Rick Sigler, director of decision support and information systems for No. 3-ranked Advanced Radiology Services, agrees with Wilgus on the importance of having enough capital to spend in key areas. “We have made the required investments in clinical applications, technology, software development, data analysis and data science to allow us to build tracking and monitoring of quality into everything we do,” he says. Sigler adds that possessing state-of-the-art technologies is essential to take full advantage of data. “The gathering of rich data allows a culture focused on quality to be implemented and made a natural part of our processes and operations,” he says.

Phelps adds that practices also need to invest in strong leadership. Without the right executives in place, groups struggle with putting the necessary systems in place. “The need for greater practice efficiency and ability to direct appropriate exams to subspecialists drives the need for a unified radiology reading platform, which is often owned by the radiology group,” he says. “Implementing and supporting these changes requires a top-notch administrative team, which also requires scale to support.”

What to Look for in 2018

This year’s Radiology 100 rankings largely represented a continuation of trends we saw emerge in the previous two years. Will 2018 be more of the same? That’s one of many things Radiology Business Journal will be tracking in the months ahead. Something else to watch: Will deep learning and A.I. become more of an issue as the technologies continue to evolve? It was the No. 5 concern according to this year’s data, but that—along with data security—could very well rocket to the top if the headlines we’ve seen in the second half of 2017 are any indication.

Overall, while private radiology practices face a growing number of challenges, the market remains strong. Phelps believes that practices can continue to find success as long as they can “continue to adapt and compete with other practice models.”

“These changes can be challenging but are achievable,” he says. “I have seen my own practice successfully meet these challenges and am optimistic about the future of the private practice of radiology.”